Exchange Rate Advantage for Canadians working in the US during 2024

The US Dollar has risen significantly against the Canadian Dollar in the last quarter of 2024. This presents an interesting anomaly that doesn’t happen every year, and it will benefit Canadian workers in the US who still maintain their Canadian tax residences.

Canadian residents are taxed on their global income. Those working temporarily in the US will report their US income on their Canadian T1 tax return and then claim credits for taxes paid to the US.

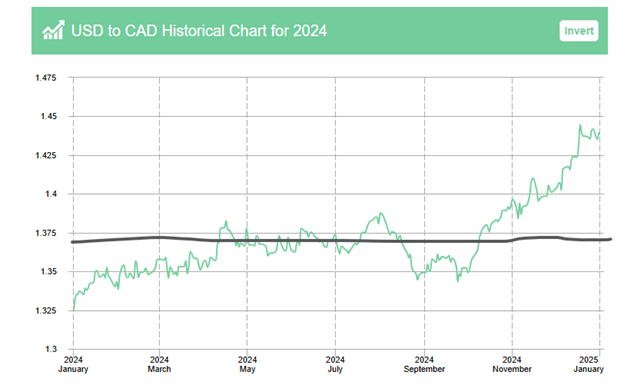

CRA uses the annual exchange rate as a default conversion factor to report the income on the T1. That rate as of January 1, 2025, is roughly 1.37. A taxpayer can use this rate as a default regardless of when the income was actually earned during 2024 (see line on chart below).

Currently, as of January 1, 2025, the exchange rate is 1.43. It may continue to trend higher due to the economic impact of President Elect Trump’s proposal to add tariffs to Canadian imports, plus the strength of the US economy as compared to the Canadian.

Let’s suppose the exchange rate stays at the current 1.43. That is a 4.4% increase in the value of the US Dollar over the annual exchange rate. If a Canadian tax resident owes CRA 1000 CAD$ and pays this with US currency, the amount in US Dollars needed to pay this is $699 vs $729 if using the annualized exchange rate. If the exchange rate continues to increase this difference will be magnified.