Catching up with back taxes at TravelTax is easier than you think!

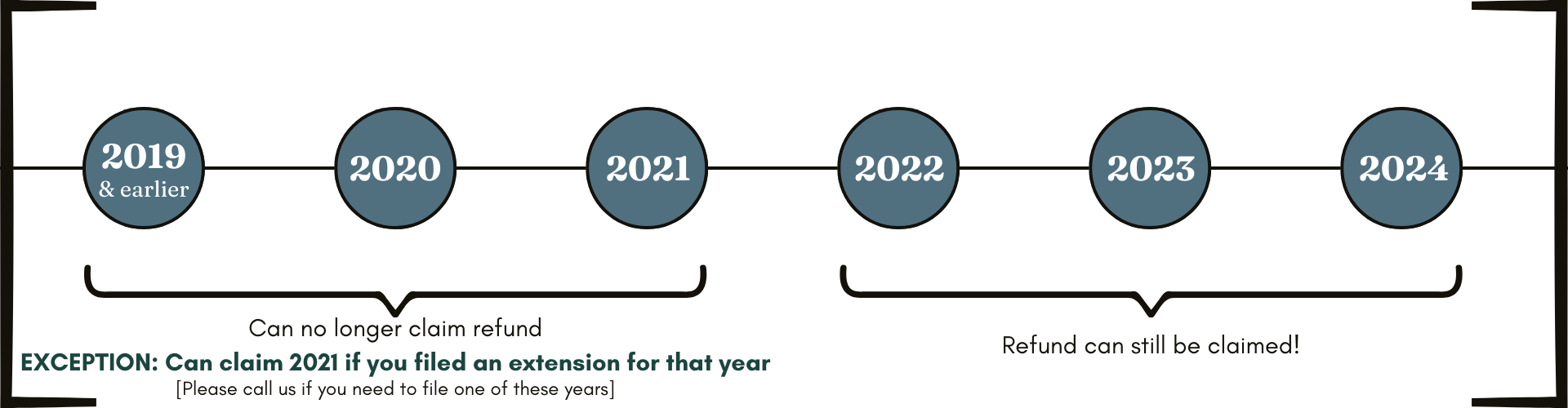

Although the deadlines for these 6 tax years have passed, we’d love to help you catch up!

Here’s how you can get caught up:

Create a client portal account and be sure to check one of the boxes under “What Brings You to TravelTax?”

Sign your Engagement of Services Agreement, and begin filling out your workbook. Be sure to indicate what years you’re filing for. You can upload documents from every year you’re filing as you go along.

Submit your workbook and wait for our team to review your documents.

Pay a $200 retainer fee for each year you need to file. This deposit will be applied toward the final invoice for each year. Once your deposit is paid, we will reach out to schedule your phone appointment.

We'll go over all of your returns in one appointment. When the returns are completed, we will upload one year at a time for your signatures/approval. Once you approve and sign, we will invoice for that year (invoice amount minus deposit). Then we will e-file for that year. Once the invoice is paid, we will repeat this process for each consecutive year.

Celebrate because you’ll be caught up on your taxes!

But what if you have a significant amount of overwhelming tax debt? Don’t panic. You may be able to settle it by paying off just a fraction of what you owe through the IRS’s Offer in Compromise program.